The retention of imported goods at customs is the worst nightmare for any company, as this situation can ruin many hours of work and cause significant extra costs. The most common reasons for a shipment being held are poorly prepared shipping marks, errors in the tariff code, lack of product approval, missing DUA, and other deficiencies in customs clearance.

All goods coming from countries outside the European Union must be declared at customs, whether they arrive by sea or air. Knowing the procedures and requirements of customs management is vital to avoid incidents.

The most common reasons for a shipment being held are poorly prepared shipping marks, errors in the tariff code, non-approved products, improperly completed DUA, and invoices that do not correspond to the value of the goods.

The fundamental customs procedures are paying the corresponding duties and the applicable VAT on the goods according to their code. The company responsible for transport declares the arrival of the shipment and, once the documentation is checked and correct, it is cleared.

Procedures to Release a Shipment from Customs

The customs agent will make the declaration on behalf of the importer, for which they must have a clearance authorization. The agent must provide the following documentation, which the importer will have previously supplied:

- EORI number, assigned by the Tax Agency, which certifies the ability to import or export

- Commercial invoice

- Transport document

- Receipt certificate

- National and community tax regime

- Import license, if the goods are subject to community restrictions

- Certificate of origin of the goods, to prove the country of origin

- AGRIM import certificate, for certain agricultural or fishery products

- CITES certificate, to ensure that endangered species are not traded

- Packing List, listing the contents of the packages

- Bill of Lading (B/L), in case of sea transport

- Air Waybill (AWB), in case of air transport

In the case of self-employed individuals, they must also present form 036, which corresponds to the equivalence surcharge.

After verifying the documentation, the corresponding taxes must be paid through an import declaration. This declaration, known as import DUA, consists of nine forms where the value, weight, total number of packages, currency, and invoice amount must be indicated.

Why Was the Imported Goods Held at Customs?

The retention of imported goods at customs is usually due to an error in the documentation. If that is the case, the solution is often quick and simple. However, it will have caused a significant inconvenience and extra cost.

Customs procedures are laborious and complex. It is most advisable to have an expert import management company like Bull Importer. This way, the importer ensures that the documentation will be presented in a timely and proper manner.

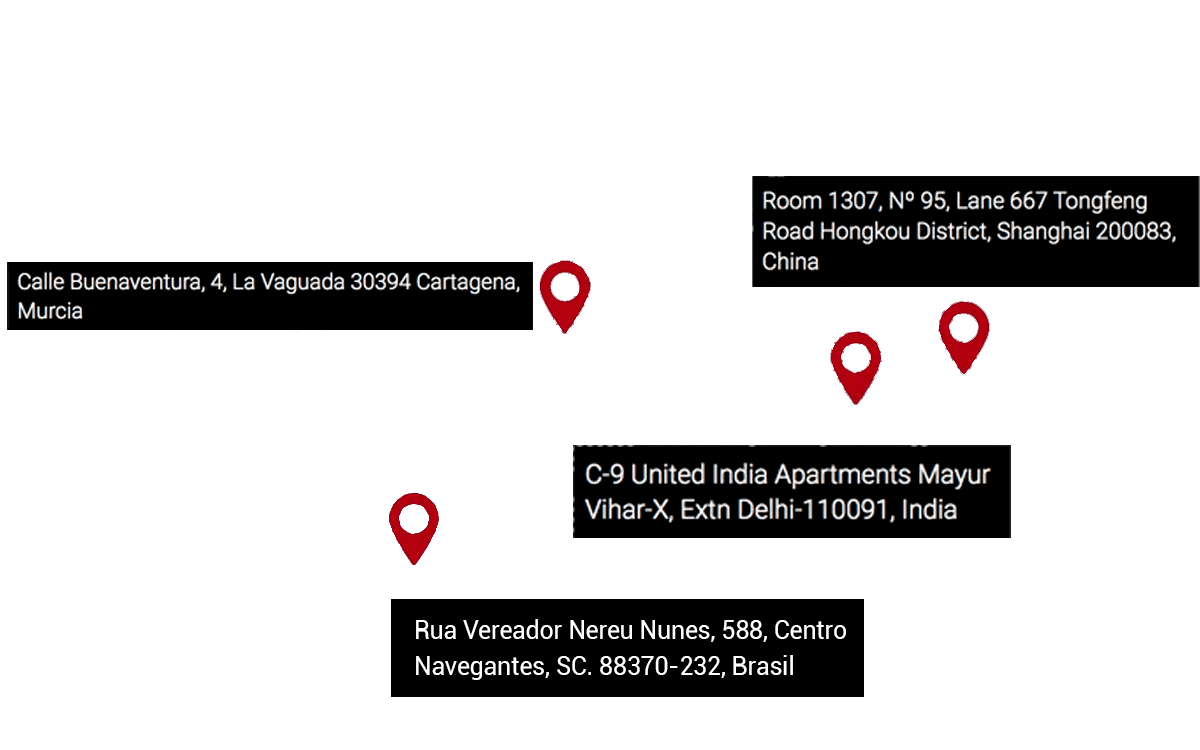

If the delay occurred in the country of origin of the product or during transit, the situation is more complex. In that case, communication with that country’s administration is necessary, with the added difficulty of language and unfamiliarity with the usual procedures.

Another problem, less frequent but more challenging to solve, is that the supplier indicated an incorrect value on the invoice or the tariff code is incorrect.

If the supplier indicated a value that is too low, customs will request the invoice from the importer to verify the amount. If both invoices match, there should be no problems. But if customs notices any irregularity in the invoice value, penalties and other issues may arise.

On the other hand, if the value is higher than its actual cost, the importer will pay more duty and VAT than necessary, resulting in an extra cost.

The best way to avoid these problems at customs is to have all documentation well-organized from the beginning and to work with a verified and trustworthy supplier.

At Bull Importer, we comprehensively manage our clients’ imports, both by sea and by air. If you want to forget about paperwork and problems with the tax authorities, request information about our advisory and comprehensive management services.