Transit cargo insurance guarantees that the insurance company will cover any possible damages and losses that the products may suffer during transportation. Although it is not mandatory, it is highly recommended to be covered by an insurance policy to prevent incidents during importation.

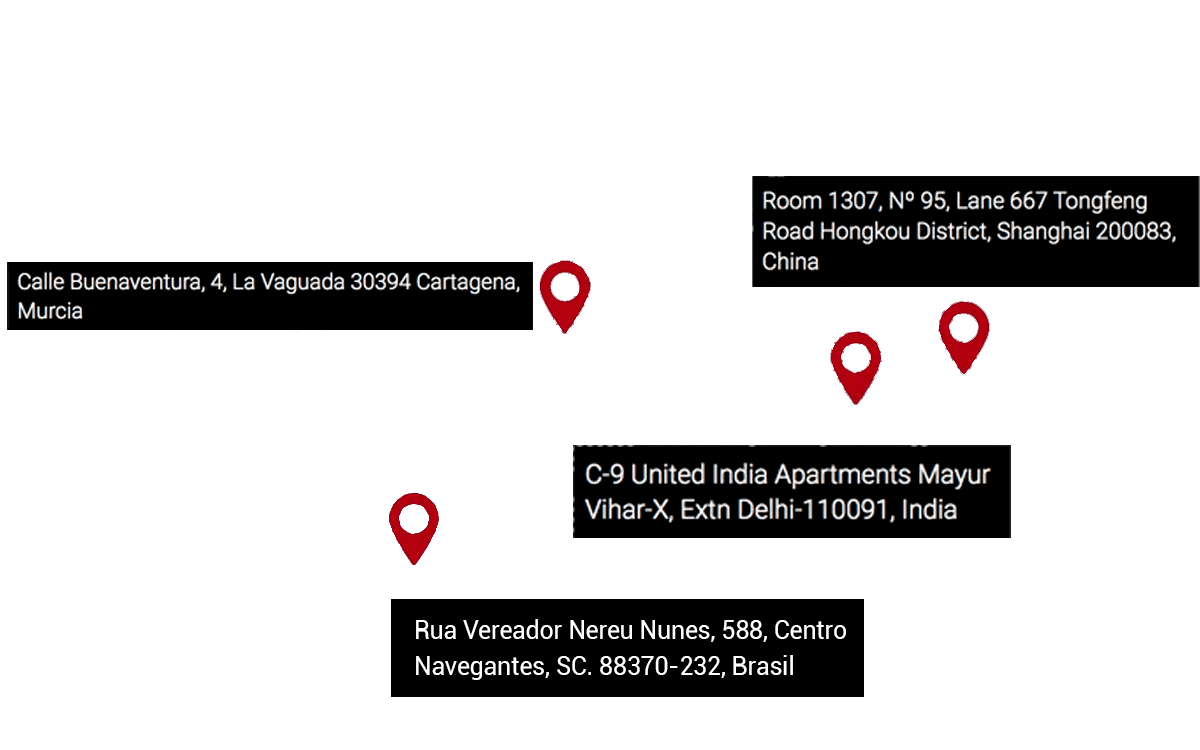

Security is an essential factor for successfully importing from China with full assurance, as it is a long and laborious process involving numerous parties. From hiring a supplier to the arrival of the goods at the importer’s warehouses, inconveniences and unforeseen events may arise. The best way to prevent them is to have the advice and support of a comprehensive management company like Bull Importer, which handles the documentation and simplifies the import process.

Contracting transit cargo insurance is the most effective way to prevent unforeseen events during loading, transportation, and unloading. Although it is not mandatory, it offers the peace of mind that every importer seeks in their international trade operations.

At Bull Importer, we advise our clients and handle all administrative matters on their behalf, such as the selection of the most appropriate Incoterms in each case, the management of customs procedures, the payment of VAT on imports, or the contracting of the most suitable insurance policies, such as transit cargo insurance or currency exchange insurance for imports.

How Transit Cargo Insurance Works

Transit cargo insurance can cover almost any type of item, according to the contract clauses. Obviously, the higher the coverage, the higher the insurance price. Generally, it is especially recommended when importing high-value goods, as they are covered against accidents, losses, theft, breakdowns, or any other incidents.

There are different types of cargo coverage. The most internationally recognized are the Institute of Cargo Clauses (ICC), which are widely used in transnational transport insurance operations.

The ICC are three international coverage clauses valid for land, sea, and air transport. They are classified by letters (A, B, C). The first offers the most coverage, equivalent to all-risk insurance that protects against any damage. The second covers exceptional events such as fires, collisions, explosions, or overturns. The third covers only losses or delays in the delivery of goods but does not consider other aspects such as poor placement or the goods getting wet during loading or unloading.

When contracting transit cargo insurance, several factors are considered to calculate the value of the policy:

- Amount of the commercial invoice

- Freight costs

- Percentage for import and origin costs

- Any other relevant data

As with any insurance policy, there are always situations that are not covered, and it is necessary to know them before signing the contract. This limitation is intended to prevent cases where the insured does not act in good faith.

The circumstances that the insurance may not cover include:

- Manifest defect

- Inadequate packaging

- Negligent behavior of the carrier

- Fraudulent behavior of the insured

However, contracting transit cargo insurance provides more benefits than drawbacks and can save a lot of trouble and money. The key is to choose the clauses that best suit the type of goods to be imported.

At Bull Importer, we have qualified and experienced staff who can advise you on all matters related to importation, including the most suitable insurance for your operation.