The import letter of credit is a document by which the importer commits to paying the supplier of the goods. It is considered the safest payment method in imports, as it is the customer’s or importer’s bank that undertakes to pay the exporter’s bank the agreed amount of money in the international sales contract.The main advantage of the import letter of credit is that it equally protects the seller or exporter and the buyer or importer. This document guarantees payment to the exporter as long as the terms of the agreement are met. Similarly, if the buyer does not receive the goods, with the letter of credit, they can stop the payment process from their bank to their supplier’s bank.The letter of credit guarantees the importer that payment will not be made until the goods have been shipped. The buyer’s and seller’s banks act as custodians of the money during this process.The security provided by the import letter of credit is why it has become one of the most widely used payment methods in international trade. The letter of credit or documentary credit is a legal agreement recognized by the International Chamber of Commerce and widely accepted by shippers.

Operation of the import letter of credit

The documentary credit requires compliance with certain conditions by the exporter and the importer. Since the document functions as a legal contract, it must include the main data of the operation:

- Port of origin

- Port of destination

- Modes of transportation

- Shipping line

- Consignee

- Recipient of notifications

- Description of goods

- Required documents

- Deadline for shipping the goods

Once the letter of credit for importation is signed, the buyer’s bank issues the document and sends it to the seller and their bank. The seller prepares the goods and ships them. Their bank verifies the transaction and proceeds with the payment.The seller’s bank contacts the buyer’s bank to check the documents and, if everything is in order, the latter reimburses the money to the seller’s bank. The buyer’s bank notifies its client that the transaction is underway. At that point, the buyer pays the money to their bank, which signs the Bill of Lading to release the goods at the destination.

Aspects to know about the import letter of credit

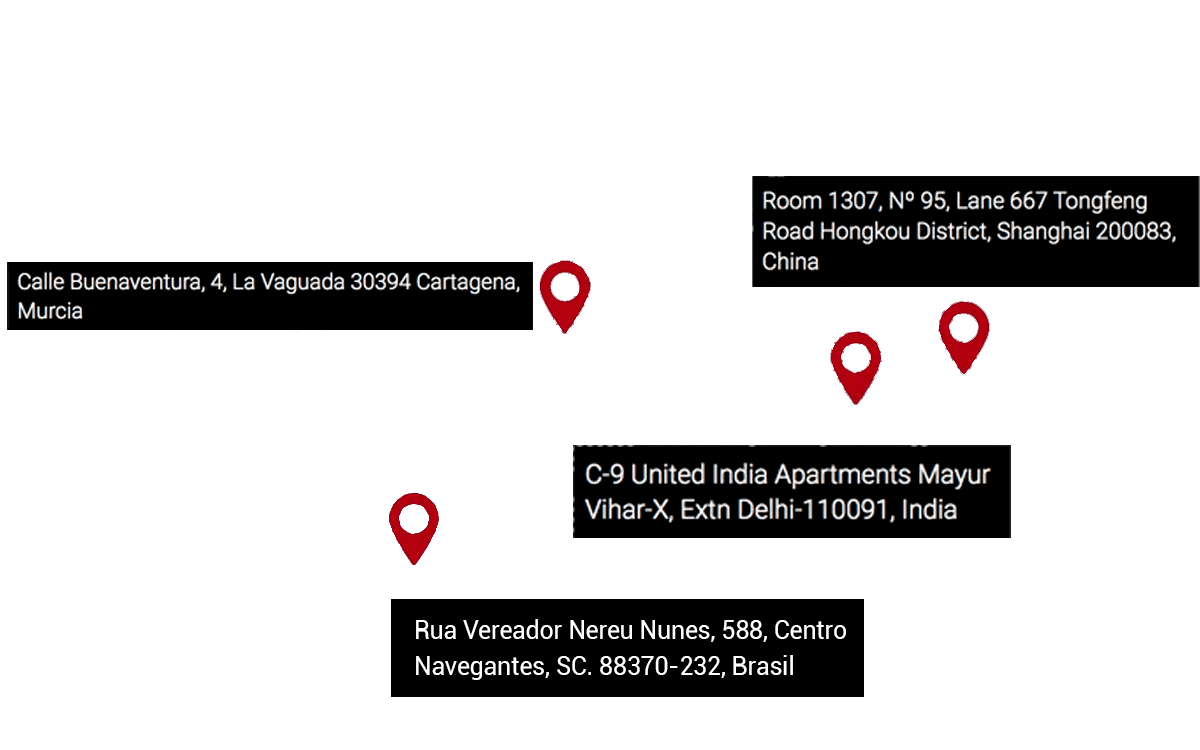

Usually, this service is not free. Banks usually charge a commission for processing the letter of credit, so it is advisable to check the fees of several entities. On the other hand, although the import letter of credit is a very secure payment method, an error in the documentation can result in financial losses and significant delays.It is advisable to hire a company to manage the entire import process and verify firsthand that the goods listed match those that have been loaded. If there are discrepancies, a company like Bull Importer, with international offices, can renegotiate on your behalf and quickly establish new conditions or compensations for potential losses.