Examine the reputation of the manufacturer and the products they offer

Make sure to research the manufacturer and their products as thoroughly as possible before making your purchase. Consider checking general online reviews about the manufacturer to get a better idea of the overall quality of their products. Also, consider looking for specific reviews about the products you are considering buying or requesting samples to test them first.

The offers for importing products from China that are excessively cheap often hide unpleasant surprises for buyers. Many sellers falsify documentation to avoid paying taxes in Europe, transferring the responsibility for the fraud to the buyers. To avoid a visit from the tax inspector, it is better to entrust imports to a professional service that manages them and keeps all the buyer’s tax documentation in order.

The strong push of Chinese products has favored the emergence of unreliable companies seeking additional profits by falsifying invoices to avoid paying VAT and tariffs. Entrusting the process to a company that operates legally is the best way to avoid problems with the tax authorities or customs.

To avoid unpleasant surprises with the tax authorities, it is better to entrust imports to a company that manages operations with complete legality

The low prices on Chinese online shopping sites are a big draw for European buyers, who are often unaware that invoice falsification and tax evasion at customs are the norm.

The control of packages is hindered by the large volume of non-EU postal traffic, which favors tax and tariff fraud. For this reason, Brussels has decided that, starting in 2017, all shipments will be subject to greater scrutiny.

The lack of staff in customs and postal services is another factor that prevents the thorough control of goods arriving from outside the European Union. About 150 million packages exempt from VAT are imported annually, a huge amount that contributes to massive fraud. This has led to a paradox: despite the increase in shipments from China, payments to the tax authorities are decreasing.

Most common mechanisms for tax fraud

One of the systems used to evade customs is the green letter, a form (the CN22) created for use in shipments between individuals but fraudulently used by some companies in their sales. Additionally, agreements signed between public postal companies to curb competition from private courier companies have streamlined procedures but at the cost of minimal control.

Shipments using the CN22 form are not registered electronically, so their origin is lost, preventing the CNMC from correctly assessing the rise in trade with China. Thus, importers take advantage of this lack of control for their operations outside the law.

In any case, European authorities, aware of the problem, are beginning to take measures to prevent tax evasion and customs fraud by both companies and individuals. Companies suspected of having acquired goods from China in recent years without paying the corresponding fees may receive a visit from tax inspectors.

Importing goods from China legally is possible. DDP services (delivered duty paid to your company).

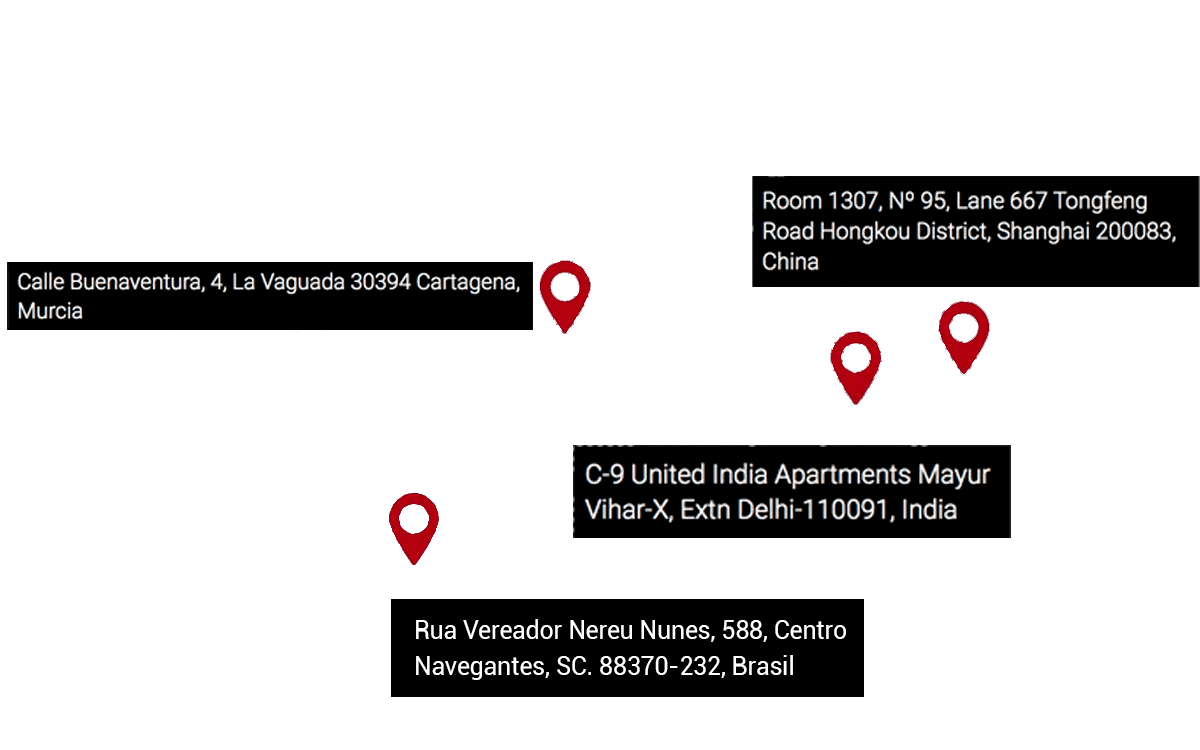

The best way to avoid problems with the tax authorities or customs when buying from China is to entrust the process to a company that operates legally. At Bull Importer, we include all your operations in a single invoice in euros, making the process completely transparent and inspection-proof.

Bull Importer provides its clients with a report on the inspection carried out in the country of origin where the legality of the transaction can be verified. In the single payment in euros, all costs and taxes generated are included:

- Cost of manufacturing or purchasing products, which can be processed with European letters of credit.

- Labeling, shipping mark, and certifications, ensuring that the imported items comply with European regulations and are handled and labeled properly.

- Payment of certificates that authorize the commercialization of the products and guarantee the payment of the corresponding fees.

- In situ inspection of the goods to verify that they meet the specifications and have visible certificates and approvals.

- Arrangement of appropriate transport (ship, plane, or train) and suitable packaging in each case to ensure the items arrive in the best condition.

- Customs clearance to formalize import declarations to the tax authorities and pay entry fees to the destination country.

- Payment of transport and tariffs, the final step necessary to receive the goods at the client’s premises with all tariff costs in order. Always, everything in order.