Avoid risks and get all import solutions in one company. Discover how our services can improve your business profitability and help it grow.

Tariffs are the taxes paid by the importer according to the TARIC goods classification system. The tariff heading, the country of origin of the goods, and the country of destination are used to calculate the taxes and to determine if certain import requirements must be met. Knowing and correctly applying the tariff headings avoids significant financial losses due to fines, returns to the country of origin, or destruction of goods at customs.

The TARIC code applies different rules to the importation of products from third countries. Goods are classified under tariff headings and receive a unique and specific nomenclature based on which the tariffs are applied.

The importer must pay the taxes to receive the goods. If customs authorities detect an error in the classification of the tariff heading, they can fine the importer, require additional tax payment, or even return the goods to their origin. The criteria for tariff classification are complex, so to avoid unexpected issues, it is advisable to delegate this task to an import management expert like Bull Importer.

Classification of Tariffs

Tariffs are a type of tax and, as such, can vary in amount based on various criteria. In some cases, certain goods are exempt from payment depending on the country of origin and international agreements.

The common types of tariffs are:

- Ad-Valorem. These are the most common tariffs. They are calculated by applying a percentage to the value of the imported goods.

- Specific. These tariffs are calculated by volume or quantity. They are usually applied based on the weight or units of goods.

- Mixed. These are a combination of the previous two.

- Compound. These are more complicated to calculate as they combine different criteria and regulations.

- Agricultural Policy-Related Duties. These tariffs are usually a combination of mixed and compound tariffs.

Although these are the most common, they are not used in all cases or in all countries. Sometimes, temporary measures reduce, increase, or eliminate the taxes. Therefore, it is crucial to know the applicable regulations for each import.

Classification of Goods by Tariff Headings

Tariff headings are used to classify goods according to their raw material, type of processing, and form of presentation, among other criteria.

The origin of the goods affects the application of tariffs, and except for products entirely manufactured in one country, the classification is usually complex as it combines different variables and customs regulations.

These are some of the criteria considered for the classification of tariff headings:

Natural Products

- Unprocessed, that is, raw vegetable, mineral, or animal materials.

- Processed, for example, raw materials that have been frozen or dried.

Finished Products

- By type of manufacture. Classified by their composition and degree of processing.

- By function. Classified by their use, destination, or primary function.

Form of Presentation

The form of presentation of the goods can be imported in bulk, vacuum-packed, disassembled, etc.

Wholly Obtained Products

These are considered wholly obtained if they are entirely manufactured in a single country.

Products with Substantial Transformation

In this case, the country of origin is usually considered to be where the last transformation or the most significant processing took place.

Products with Insufficient Transformation

This criterion can apply to goods that are packaged, assembled, or separated by lots.

As seen in this brief summary, assigning the origin of the goods and the tariff heading requires in-depth knowledge of classification methods to avoid mistakes.

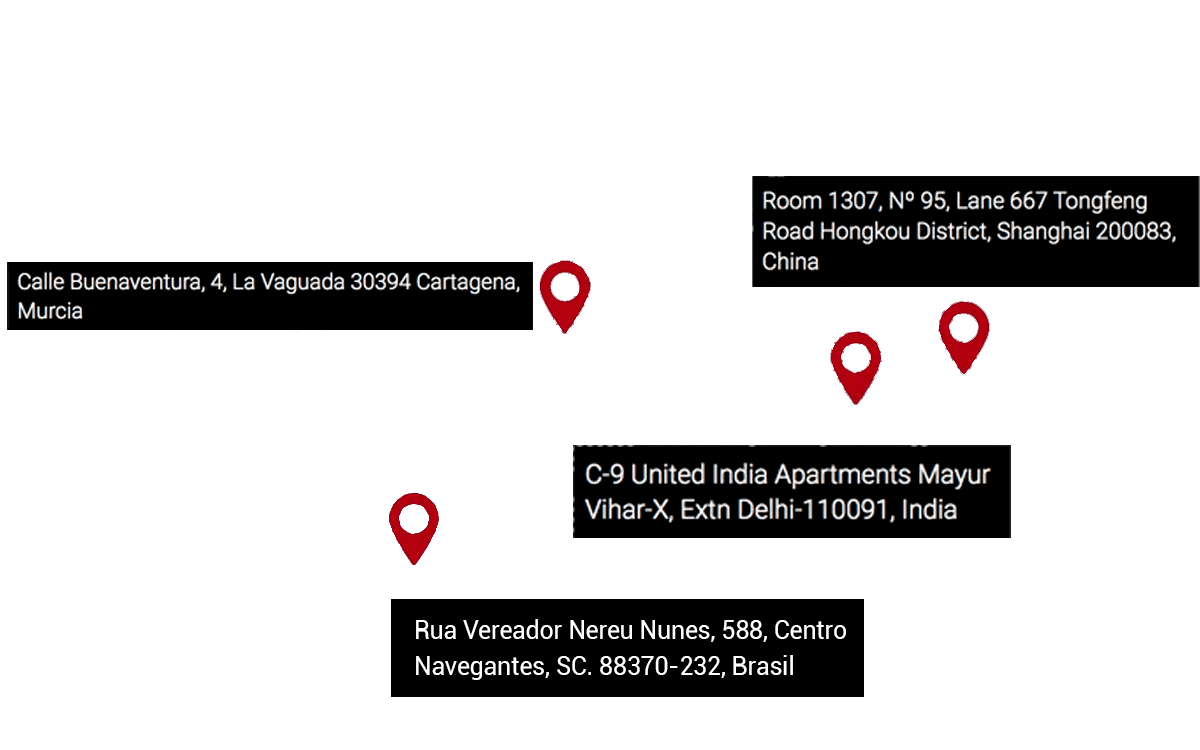

Our experience enables us to streamline our clients’ import operations, such as tariff classification. If you wish to import goods from Asia, do not hesitate to consult our management services.

What do you get with us besides peace of mind and security?

- We verify that the product certificates and the product itself comply with current regulations such as CE, RoHS, etc.

- We verify that the supplier or manufacturer is legal, exists, and is solvent.

- We ensure that the importer (you) meets all the requirements for importing and has the necessary import license. Depending on the product, a specific license may be required. If you do not have the licenses, do not worry, at Bull Importer we have many solutions.

- We verify the total cost of importation with all taxes and tariffs included up to your company or warehouse, knowing all the import costs in advance.

- We manage samples from your supplier or manufacturer so you can check that the quality matches what you requested.

- We inspect the goods before shipment to ensure that the manufacturer has not changed anything from the agreed terms.

- We fully manage the importation, from the manufacturer to your warehouse, taking care of all the paperwork and procedures without you having to worry about anything.

- You obtain a comprehensive procedure, patented in Intellectual Property, that guarantees the entire purchase and import process.

- Your business grows thanks to our comprehensive management, becoming your purchasing and import department at zero cost, ensuring continuity and incorporating import product lines into your business at zero cost.